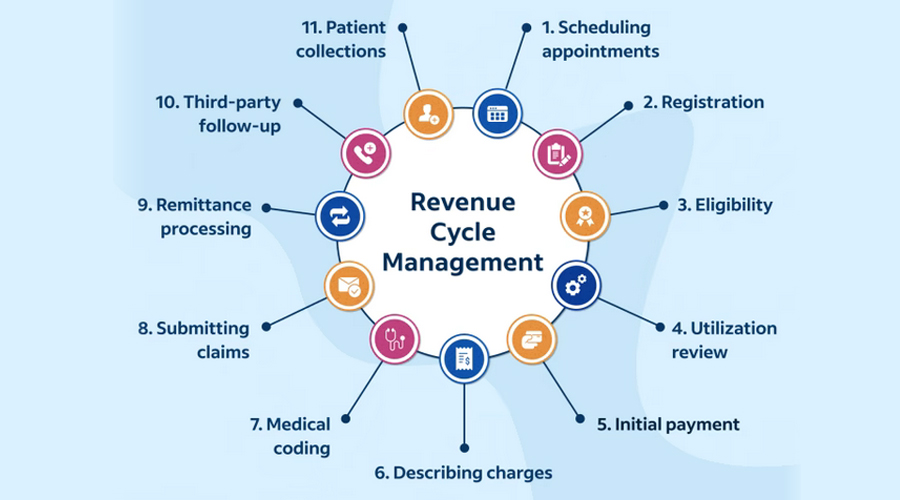

Revenue Cycle Management

We help healthcare providers collect more revenue. Our end-to-end RCM services focus on the entire revenue cycle. This includes validating demographics, benefits, prior authorizations, billing, collections, making patient calls, and reporting.

Eligibility Verification

Offering eligibility verification services aids healthcare providers in submitting error-free claims, which, by preventing the need for claim resubmission, minimizes eligibility-related rejections and denials within the revenue cycle management (RCM) process. This, in turn, leads to enhanced revenue collection rates and an elevated level of patient satisfaction.

Benefits Verification

We specialize in swiftly and precisely verifying primary and secondary coverage details, encompassing member ID, group ID, coverage period, co-pay, deductible, co-insurance, and comprehensive benefits information. We ensure an efficient connection with payers through optimal communication channels.

Prior Authorization

Our service encompasses obtaining prior authorization, a prerequisite mandated by health insurance companies to validate the medical necessity of expensive procedures. This entails securing approval from the provider before administering specific services, procedures, diagnostics, medical devices, and prescription medications.

Charge Posting

We specialize in the meticulous recording and billing of charges for the medical services and procedures delivered to patients. This step is vital as it guarantees the precise and timely reimbursement of your practice for the services rendered to patients.

Denials Management

Our service involves the thorough investigation, analysis, and resolution of denied insurance claims, which constitutes a critical component of medical billing and revenue cycle management (RCM). RCM is employed to enhance both the administrative and clinical processes within a revenue cycle, ultimately leading to improved financial performance and operational efficiency.

A/R Management

Our Accounts Receivable team compares expected and actual collections, understands the causes of discrepancies, and takes corrective measures to recover the difference. MedergyRCM's systematic and regulated processes during each phase of the revenue cycle allow our AR team to maintain Days in AR below 25. An initial analysis of old outstanding receivables is performed whenever a new client joins MedergyRCM, and corrective action is taken to recover as much revenue as possible from claims filed prior to the client joining MedergyRCM. Unpaid claims are processed using a prioritization-based method, giving top priority to high-value claims and claims approaching the insurance timely filing limits. Any underpayment in the contracted amount or reimbursement rate by the insurance company is also flagged, and corrective action is taken.

Payment Posting

Insurance payments are posted to patient accounts from the EOB. All payments received will be posted within 24 hrs. For payers who do not have Electronic Remittance (ERA), our team manually posts the insurance payments into the patient’s account matching the respective allowed amount for each charge. To ensure that all payments received are posted, we compare bank deposits with the total payment posted in the PMS. If the patient has co-insurance, the remaining unpaid charges will be filed to the secondary insurance as per the coordination of benefits. Any deductibles, copays, Out-of-Pocket, and other patient responsibility stated by the insurance will be billed to the patient when the statements are generated. Before generating statements, we ensure that the patient account balance is correct and they are not billed for balances for which they are not liable. Patients’ statements are generated on a monthly basis.

Claim Management

We stress the importance of effective claim management for healthcare providers, as it plays a crucial role in maintaining financial stability, minimizing claim rejections, and securing accurate reimbursements. This requires expert knowledge of medical coding, insurance guidelines, and the ability to adapt to ever-evolving healthcare policies and procedures.

Reporting

Our service in medical billing encompasses the creation of diverse financial and administrative documents and data, ensuring precision in billing, optimizing revenue, complying with regulations, and facilitating well-informed decision-making within a healthcare practice.

Reporting plays a crucial role in medical billing for several reasons: They are,

- Financial Transparency: Reporting provides a clear and transparent view of the financial transactions within a healthcare practice. It includes information on charges, payments, adjustments, and outstanding balances.

- Claims Status: Reporting helps track the status of insurance claims. It includes information about claims that have been submitted, processed, paid, denied, or are still pending.

- Revenue Analysis: Reports can provide insights into a healthcare practice's revenue cycle. This includes identifying areas of improvement, tracking revenue trends, and assessing the financial health of the practice.

- Compliance and Auditing: Accurate reporting is essential for compliance with healthcare regulations. It also supports internal and external audits by providing documentation of financial transactions and billing practices.

- Provider Performance: Reporting can be used to evaluate the performance of healthcare providers within a practice. It may include metrics related to the number of patients seen, services provided, and revenue generated by each provider.

- Patient Statements: Reporting includes generating patient statements that outline the services received, associated costs, insurance coverage, and any outstanding balances. These statements are often sent to patients for billing and payment purposes.

- Decision-Making: Reports are valuable tools for making informed decisions about the financial aspects of a healthcare practice. Practice managers and administrators use reports to assess the effectiveness of billing processes and make adjustments as needed.

Credentialing

Our singular focus is to eliminate errors, foresee potential obstacles, and avoid delays getting you on the insurance panel of a participating provider while ensuring that you stay current. Oncospark guarantees the confidentiality and security of provider information.